Stock Prices Cluster Around Strike Prices on Option Expiration Dates

According to research done at the University of Illinois, Urbana-Champaign, prices of stocks that serve as underlying assets on options tend to cluster around the strike prices of those options on the expiration dates. This pattern is not seen in non-optionable stocks. The research paper can be downloaded from: http://papers.ssrn.com/sol3/papers.cfm?abstract-id=519044

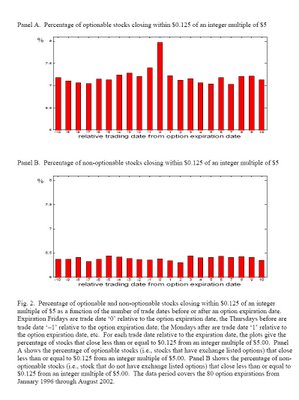

(The diagram below is an excerpt from the research paper: Stock Price Clustering on Option Expiration Dates by Ni, Pearson, and Poteshman.)

This pattern can be partially explained by delta-hedging by market makers and other sophisticated market participants. However, this benign explanation cannot completely account for the clustering of prices around option strike prices on expiration dates. The authors found that some of the clustering can be explained by the incentive to manipulate the prices of underlying assets by option writers (sellers) who have an incentive to keep stock prices close to the At-The-Money (ATM) price in order to minimize or eliminate losses.

Mark Hulbert, in his New York Times column, The Mystery of the Stock Price and the Strike Price (May 7, 2006), gave a succinct explanation for the possibility of price manipulation:

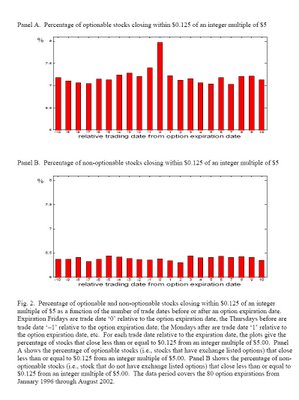

(The diagram below is an excerpt from the research paper: Stock Price Clustering on Option Expiration Dates by Ni, Pearson, and Poteshman.)

This pattern can be partially explained by delta-hedging by market makers and other sophisticated market participants. However, this benign explanation cannot completely account for the clustering of prices around option strike prices on expiration dates. The authors found that some of the clustering can be explained by the incentive to manipulate the prices of underlying assets by option writers (sellers) who have an incentive to keep stock prices close to the At-The-Money (ATM) price in order to minimize or eliminate losses.

Mark Hulbert, in his New York Times column, The Mystery of the Stock Price and the Strike Price (May 7, 2006), gave a succinct explanation for the possibility of price manipulation:

The study's authors don't disagree that market makers play a large role. But they found that the market makers' activities could not fully explain the clustering. They say it is likely that manipulation is also taking place.

Who would have an incentive to manipulate stocks this way? One group would be those who sell options short, known as option writers. Traders in this group in effect are betting that the options' underlying stocks will rise (in the case of puts they have sold short) or fall (in the case of calls). They could lose big if these stocks move too far in the wrong direction.

You would need to be a very wealthy investor indeed to be able to buy or sell enough shares of a stock to move its price in a given direction. But the researchers believe that some would qualify. They focused special attention on a group known as firm proprietary traders, which includes employees of large investment banks who are trading options for those banks' accounts. The researchers argue that these traders would be in a position to manipulate stock prices by selling large numbers of shares whose prices they wanted to keep from rising and by buying other shares whose prices they wanted to support.

0 Comments:

Post a Comment

<< Home