Behavioral Finance: Choosing the Same Portfolio at a Higher Cost

I wrote a blog a while back about behavioral economics & finance at Harvard (I specifically mentioned the work of David Laibson in that blog). I found an interesting article in the New York Times (Mark Hulbert's column) on the topic of behavioral finance: Same Portfolio, Higher Cost. So Why Choose It? (April 9, 2006).

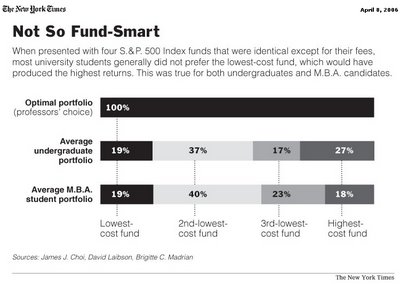

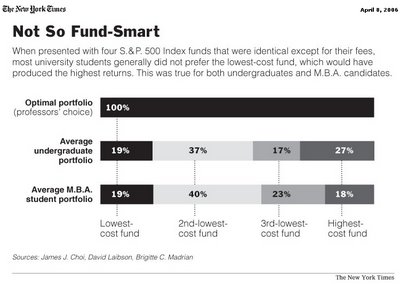

The article discusses a research paper co-written by Prof. Laibson, James J. Choi of Yale, and Brigitte C. Madrian of Wharton (Penn), entitled Why Does the Law of One Price Fail? An Experiment on Index Mutual Funds. This article discusses a series of experiments that found that students (both undergraduate and MBA) at Harvard and Wharton (both groups, by the way, scored high on tests of financial literacy given before the experiments) failed to minimize fund fees even though all of the funds were based on the same 500 stocks of the S&P 500 index! A substantial proportion of the subjects of the experiment (usually by an overwhelming majority -- approximately 80% in one scenario) choose higher cost funds even though they all had the same performance, thus, failing to maximize returns.

From Mark Hulbert's column:

This is the kind of 'anomaly' that is red meat for behavioral finance / economics researchers. I will leave you with some interesting comments made by the New York Times piece:

The article discusses a research paper co-written by Prof. Laibson, James J. Choi of Yale, and Brigitte C. Madrian of Wharton (Penn), entitled Why Does the Law of One Price Fail? An Experiment on Index Mutual Funds. This article discusses a series of experiments that found that students (both undergraduate and MBA) at Harvard and Wharton (both groups, by the way, scored high on tests of financial literacy given before the experiments) failed to minimize fund fees even though all of the funds were based on the same 500 stocks of the S&P 500 index! A substantial proportion of the subjects of the experiment (usually by an overwhelming majority -- approximately 80% in one scenario) choose higher cost funds even though they all had the same performance, thus, failing to maximize returns.

From Mark Hulbert's column:

As a result, the hypothetical portfolios built by most of the students paid much higher fees than were necessary: 1.22 percentage points more, on average, among the undergraduates and 1.12 points higher among the M.B.A. students.

This is the kind of 'anomaly' that is red meat for behavioral finance / economics researchers. I will leave you with some interesting comments made by the New York Times piece:

What conclusions emerge from all these tests? Over all, the study said, the results do "not inspire optimism about the financial choices made by most households."

The professors also concluded that the presentation of data could have a big effect on investors' decisions. And they argued that this offered a particularly important lesson for policy makers who are thinking about establishing personal investment accounts for workers in the Social Security system. Without careful guidance, the study said, most people won't be able to invest their money intelligently.

0 Comments:

Post a Comment

<< Home