‘Mind Time’ & Market Time

‘Time flies when you’re having fun.’ That old cliché is one way of summarizing the concept of mind time. As conceived of by neuroscientists, philosophers, and others interested in human cognition, mind time is a conception of time where we draw a distinction between how time is measured via clocks and how we perceive the passage of time. In this blog essay, I will make the argument that, in the financial markets, time – in terms of mind time – is stretched, contracted, and deformed in a way that is distinctly different to clock time (defined here as time measured via clocks and calendars). The various re-shaped mind times that exist among traders and investors are aggregated in the marketplace to form what I call market time. The concept of market time is, again, distinct from clock time, which is what we normally use to mark off the passage of time. Market time, which may be thought of as the application of mind time to the financial markets, has major consequences for the nature of financial risk and return.

Does time have shape? If so, can you re-shape time?

Does time have shape? This is both a simple yet, paradoxically, profound question to ask and answer. Most people, even scientists, would say that time can be thought of – if one was to consider it geometrically – as an uni-directional line: hence the often heard phrase ‘the arrow of time.’ A slightly more sophisticated way of describing this quasi-intuitive view of time is that time is one dimensional (and is one of the dimension’s of the post-Einsteinian view of ‘space-time’) and only moves (relatively speaking) ‘forward.’ [3]

Assuming time has shape, can you bend, stretch, contract, or otherwise re-shape time? To answer this question, we should make a distinction between mind time and clock time.

With mind time, the answer to the question of the flexibility of time is yes. From an intuitive perspective, for any given length of clock time, we have all experienced the sense that time was ‘slowing down’, stretched out, and/or extended when we are experiencing some exciting, mentally challenging, or stressful event. Examples of this include taking exams, receiving medical treatments, and trading in the financial markets. Neuroscientist, Antonio R. Damasio, gave an example of this from his personal experiences:

On a recent flight with heavy turbulence, for instance, I experienced the passage of time as achingly slow because my attention was directed to the discomfort of the experience. [4]When things become less nerve-racking or a situation is purely hedonic, however, we perceive time to pass more quickly even if, in terms of clock time, the absolute amount of time for either classes of events were the same.

Philosophers, in particular, Immanuel Kant, have argued in favor of this intrinsic notion of time bending and stretching in accord with human perception. Neuroscientists, including Benjamin Libet [5] and Antonio R. Damasio, have demonstrated experimentally that there seems to be a great deal of validity to the Kantian notion of time – which neuroscientists have dubbed ‘mind time.’ Prof. Damasio summarized his findings on the neuroscience of mind time in the following way:

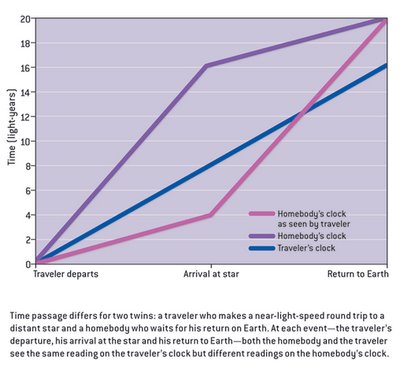

The emotional content of the material may also extend time. When we are uncomfortable or worried, we often experience time more slowly because we focus on negative images associated with our anxiety. Studies in my laboratory show that the brain generates images at faster rates when we are experiencing positive emotions (perhaps this is why time flies when we’re having fun) and reduces the rate of image making during negative emotions. [6]But what about clock time? Is clock time – what we normally think of as the ‘proper’ measurement of time – malleable as well? Intuition would seem to suggest no. Physics, however, suggests that the shape of clock time may also be flexible. Einstein, as a part of his Theory of Relativity, came up with a thought experiment known as the ‘Twin Paradox.’ According to Relativity, a traveler moving at great distances through space at close to the speed of light would experience clock time at a substantially slower pace than would his or her twin who is relatively stationary. [7] Even quantum mechanics seem to suggest that clock time may not be as deterministic as we may intuitively believe it to be. [8]

Before we move on, it’s worth noting what it would mean to re-shape either mind time and/or clock time. Time, as has been already mentioned, is one dimensional (practically speaking). When time is deformed, it may no longer be one dimensional since it may not be a platonic ‘line’ in the strict Euclidean sense. Is it two dimensional (or have an even higher dimension)? Perhaps. But, it is probably more mathematically correct to think of it as having a dimensionality somewhere between one and two (or more) dimensions. In other words, rather than thinking in terms of integer dimensions (1, 2, 3, …), we should think of deformed time as occupying fractional dimensions (1 1/4, 1 1/3, 1.5, etc.). When we are dealing with fractional dimensions, we are really dealing with fractals (‘fractional dimension’ or, what Benoit Mandelbrot might call ‘the degree of roughness’, being one aspect of the notion of fractals).

The application of fractals to the flexibility of mind time (and, I suppose, to clock time as well) leads us into to the implications of mind time for the risk and return characteristics of financial markets.

The fifth heresy of finance

“In markets, time is flexible.” According to Benoit Mandelbrot and Richard Hudson, this maxim is number five on their list of the “Ten Heresies of Finance.” As we saw in the second of the introductory quotes to this essay, in Mandelbrot’s multifractal view of financial market dynamics, time “stretches and shrinks …. We perk up during high drama, nod off when bored. Markets do the same.” [9]

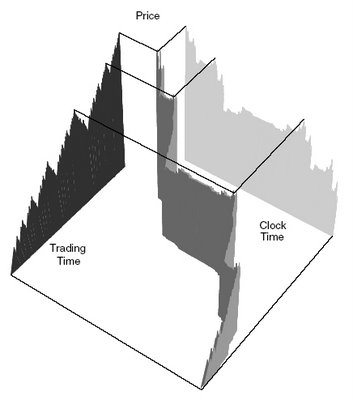

In Mandelbrot’s Multifractal Model of Asset Returns, we can start by generating price movement using the usual models (e.g., geometric Brownian motion) using normal clock time time-scales. We can then use another generator to transform clock time into a new time-scale, which Mandelbrot calls “trading time” and which I call ‘market time’ (I will explain why I prefer this nomenclature later in this essay). Mandelbrot’s “trading time” is flexible and malleable; to put it another way, in financial markets, time-scales are rough, i.e., market time is fractal.

Using the ‘clock time-trading time’ generator, periods of large price movements get expanded, periods of relative quiescence are compressed. We can then use the ‘clock time-trading time’ generator to translate the original price movement generator into a model of asset prices that better resembles actual market conditions than standard neoclassical models used in finance. In Mandelbrot’s (and Hudson’s) words:

[The final price chart] fluctuates wildly. It has the big jumps and “fat tails” we find in real price charts, as well as the long-term dependence and persistence of the real thing. [10]

Benoit Mandelbrot is not alone in believing that “in markets, time is flexible.” Emanuel Derman has theorized that market participants may perceive risk and return in terms of what he calls “intrinsic time” (of course, I refer to this as ‘mind time’ and/or ‘market time’). Derman has incorporated this more malleable conception of time into a modified version of the Capital Asset Pricing Model (CAPM). [11]

So far, we have seen that the neuroscience and philosophical concept of mind time seems to be analogous to and runs parallel with Mandelbrot’s fractal ‘trading time’ and Derman’s ‘intrinsic time.’ Can we tie these concepts together more directly?

We can connect these ideas together if we accept that perception, emotion, and behavioral/cognitive cues & heuristics, play a significant role in financial decisionmaking in the marketplace. There is a growing body of research in behavioral finance & economics, as well as the new field of neuroeconomics, that support the idea that perception, emotion, and other factors not associated with a rigid conception of Homo economicus play substantial roles in financial economic decisionmaking.

One particularly interesting piece of research in this area has been conducted by Andrew Lo and Dmitry Repin. According to research they conducted in a clinical (both in the quasi-medical sense, since equipment used to monitor physiological states was used, and in the sense that the research involved practitioners of finance, in this case traders in the Boston area) setting, they found real-time physiological data that showed statistically significant signs of emotional responses to periods of increased market volatility. [12] If we tie this bit of evidence together with research done by neuroscientists on how mind time stretches during periods of intense emotional exertion, we can see that Mandelbrot and Derman’s conception of flexible time in the markets is an aggregation of the individual mind times at work among market participants.

Mind time, market time, and risk and return

Before we delve into the implications of all of this for financial risk and return, let me define what I mean by market time and why it is important to distinguish this concept from the other concepts offered to explain the flexibility of financial time-scales.

I define market time to be the aggregation of all of the individual mind times of the participants in a financial market. Market time can be thought of in both a macro and micro sense. Specifically, we can define a market time for an entire market or markets of financial assets or we can define a market time for particular segments of any particular financial markets. In a similar vein, we can define a market time that is an aggregation of the mind times of all market participants – traders, investors, et al. – or we can define market times for individual categories of market participants.

One of the reasons why I prefer to call this aggregation of mind times ‘market time’ – as opposed to ‘trading time’ or ‘intrinsic time’ – is because different participants in a market make decisions based on differing time-scales. Traders make decisions based on a framework of days, hours, minutes, and, even, seconds. Investors make decisions based on time-scales that span weeks, months, quarters, and years. The differing time-scales will have differing affects on the shape of market times – whether those market times are defined in macro or micro terms. Thus, it is important to keep in mind that the flexibility of time is not solely dependent on the mind times of traders. The roughness of time-scales in the markets can also depend on the aggregate mind times of long-term investors and other participants in the market that have time-scales that may or may not be similar to that of short-term traders.

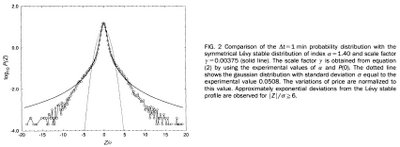

So how does mind time or market time affect the nature of financial risk and return? Following the logic of Benoit Mandelbrot’s Multifractal Model of Asset Returns, the flexible nature of market time causes financial risk to be more discontinuous and ‘jumpy’ as well as more persistent and correlated than standard financial theory allows for. The introduction of ‘rough,’ fractal-dimensioned market time – even when the underlying price movement generator is Gaussian Brownian motion – causes the underlying distribution to resemble a fat-tailed (i.e., makes extreme deviations from the center of the distribution more likely than the so-called ‘normal’ distribution would allow for), non-Gaussian Levy stable distribution.

In plainer English, acknowledging the reality that time is flexible in the markets means that we must acknowledge the reality of catastrophic risk of greater magnitudes and frequency than we can with the currently dominant models of finance. This kind of risk – called ‘wild randomness’ by Benoit Mandelbrot and Nassim Nicholas Taleb – is considerably more worrisome than the ‘milder’ variety of risk that is suggested by the so-called ‘normal’ (or log-normal) distribution. [13]

Like the turbulence that Damasio felt while flying, traders and investors will experience financial turbulence because of the specter of ‘wild’ risk in the markets. There is an important difference, however, between turbulence felt in the air and turbulence felt in the markets. Atmospheric turbulence is an exogenous force that deforms the shape of mind time – the perception of the temporal nature of the experience. Market turbulence is, at least in part, endogenous to the market; the collective force of mind times – what I have termed market time(s) – serve to create and/or reinforce the turbulence that further deforms both the shape of perceived time as well as the shape of the distribution of prices and returns (relative to the ‘normal’ distribution).

A few distinctions need to be made between short-term traders and longer-term investors when discussing the affects of malleable mind time / market time on the nature of financial risk and return. Both groups will feel the jarring affects of fat tails and long-term dependence but to varying extents relative to their differing time-scales.

Short-term traders will experience the bumps and bruises of financial turbulence in a much more visceral and intense way relative to long-term investors. Because the first and second central moments of a probability distribution – the mean (expected value or expected return) and variance (standard deviation), respectively – are undefined with the kind of high-peaked, fat-tailed distributions that can result from a world of malleable market time, traders cannot unreservedly place their hopes in the traditional tools they have to ‘hedge’ risk or take advantage of arbitrage opportunities.

In fairness to defenders of more traditional views of finance, one thing worth pointing out that sometimes fails to get noticed among the growing chorus of praise for power laws and fat tails in finance is that most of the time – in terms of clock time (but not mind time) – markets are relatively prosaic. The high-peakedness and the relatively ‘hollowed out’ area between the peak and the extremes in the distributions suggested by most pro-power law, pro-fat tail financial research means that, most of the time, traders will be able to make their Shakespearean “pound of flesh” doing what they usually do with the usual set of tools. In terms of mind time / market time, however, the periods of financial turmoil and turbulence will be extended relative to clock time. Those times of bumps and jumps will either make or break fortunes. The ‘usual’ ways of doing things does not adequately take the potentially catastrophic – either catastrophic ‘success’ or, more often than not, catastrophic failure – affects of flexible market times into account.

Long-term investors will also be affected by market turbulence. However, because they make decisions based on longer time-scales, investors may be able to diversify away some of the nastier risks and be able to smooth out the bumps from the returns on their suitably diversified portfolios. [14] Long-term diversification – if properly carried out – is potentially more robust than dynamic hedging over short time intervals. While investors should not blindly rely on ‘expected return’ or ‘standard deviation’ any more than their trading brethren, investors – via a properly diversified portfolio – might be able to rely on the median of the distribution since the median, while not easy to express mathematically for non-Gaussian Levy stable distributions, does exist for the high-peaked, fat-tailed distributions that we increasingly see in the more promising research into financial econophysics. [15]

When time crawls

Hopefully, we can see the connections between neuroscience, philosophy, mathematics, and, to some extent, physics, and an increasingly sophisticated body of quantitative financial research that suggests that time is flexible and that this malleability of time – or, at least, the perception of time – has some very substantial consequences for the nature of risk and return in the financial markets. Exploring this intersection between the mind and the market led me to create a catchphrase that nicely encapsulates the lessons to take away from this essay: Time crawls when you’re money is at risk.

Notes:

The first figure comes from Lasky, infra note 7. The second figure comes from Benoit Mandelbrot & Michael Frame, Fractals, Graphics, and Mathematics Education (Mathematics Association of America, 2002). The third figure comes from Mantegna & Stanley, infra note 15.

[1] This quote is from Norman Kemp Smith’s classic translation of Kant’s Critique of Pure Reason (2nd ed., Palgrave Macmillan, 2003).

[2] This quote is from the UK paperback edition of Mandelbrot and Hudson’s book. I’m presuming the American version is the same (except for pagination and the spelling of ‘behavior’). The bibliographical information for the U.S. version is Benoit Mandelbrot & Richard L. Hudson, The (Mis)Behavior of Markets (Basic Books, 2004).

[3] It is worth noting that some physicists have made the argument that time does not necessarily have a fixed direction (it only seems that way). In other words, time might not be an arrow. For more on this, see Paul Davies’About Time: Einstein’s Unfinished Revolution (Simon & Schuster, 1995) as well as Paul Davies’ articles for Scientific American Special Edition (2006): A Matter of Time. For a more philosophical / historical take on the physics of time, see Palle Yourgrau’s A World Without Time: The Forgotten Legacy of Gödel and Einstein

(Basic Books, 2005).

[4] From Antonio R. Damasio’s article in the Scientific American: A Matter of Time (2006), Remembering When (from the sidebar, How Hitchcock’s Rope Stretches Time).

[5] In fact, Benjamin Libet, of UCSF, seems to have coined the term ‘mind time.’ See his book Mind Time: The Temporal Factor in Consciousness (Harvard Univ. Press, 2004).

[6] From Damasio, supra note 4.

[7] A good description of the Twin Paradox is Ronald C. Lasky’s How does relativity theory resolve the Twin Paradox? (found on the website of Scientific American). An extremely brief tutorial on Relativity can be found at http://www.astro.ucla.edu/~wright/relatvty.htm

[8] See Hans Reichenbach, The Direction of Time (Dover, 1999, republication of Univ. of California Press, 1956).

[9] Mandelbrot & Hudson, supra note 2.

[10] Ibid.

[11] Emanuel Derman, The Perception of Time, Risk, and Return During Periods of Speculation (Quantitative Finance, 2002, vol. 2, 282-296).

[12] Andrew W. Lo & Dmitry V. Repin, The Psychophysiology of Real-Time Financial Risk Processing (Journal of Cognitive Neuroscience, 2002, 14:3, pp. 323-339).

[13] Both of these gentlemen have written extensively on these concepts. See, e.g., Benoit Mandelbrot & Nassim Taleb, A Focus on the Exceptions that Prove the Rule (published in a Financial Times supplement on “Mastering Uncertainty”, 2006). Copies of this article are available (divided into two pages) at:

http://www.fooledbyrandomness.com/FT-1.pdf

http://www.fooledbyrandomness.com/FT-2.pdf

[14] The emphasis is on ‘suitably’ for a reason: Most so-called diversified portfolios are probably not nearly diversified enough in relation to non-Gaussian distributions that give a more accurate picture of the nature of financial risk. See Mandelbrot & Taleb, How the Finance Gurus Get Risk All Wrong (Fortune, July 11, 2005).

[15] One of the pioneering papers in this genre was R. N. Mantegna and H. E. Stanley, "Scaling Behaviour in the Dynamics of an Economic Index," Nature 376, 46-49 (1995).

0 Comments:

Post a Comment

<< Home